34+ does a heloc affect your mortgage

It is possible to have a home equity loan and HELOC on the same property as long as you have enough home equity to qualify for both programs. Retain at least 20 equity in your home after the home equity loan.

How To Buy A House Before Selling Your Current House

Keep your HELOC balance low.

. Web Managing your HELOC responsibly can help protect your credit score. While guidelines vary you can typically access up to 85 of your homes equity with a. 250000 x 08 Maximum cash available.

Web A HELOC or home equity line of credit is a way of borrowing money against the value of your home. Web Yes opening and using a HELOC will affect credit score but whether the impact is negative or positive will depend on how well you manage your line of credit. Avoid applying for other types of credit when you apply for a HELOC.

The new credit factor represents 10 of your FICO score. Some credit histories also include cell phone bills and rental property agreements. Establish a budget that includes a plan for making monthly repayments.

Borrowers are pre-approved for a. Regardless of your goal avoid a HELOC if. To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance.

Thats because the amount of the HELOC plus the amount you owe on your mortgage can be no higher than 200000. It can be difficult to budget or make. If your house is worth more than you owe on your mortgage you may be able to use your home equity to pay for improvements consolidate high.

Web If you put 20 percent down on your home for example you own 20 percent of your home at the start of your loan. For example suppose your house is worth 350000 and you still owe 110000 on the mortgage. To qualify for a HELOC you should have at least 15 to 20 equity in your home.

Make payments on-time to your home equity line of credit. A month ago the average rate on a 30-year fixed mortgage was lower at 653. Your income is unstable.

Web A HELOC is a revolving credit line that you can repeatedly tap and pay offsimilar to a credit card. But if you make late. Like a home equity loan its secured by the property but there are some differences in how the two work.

Over time the amount of equity you have in your home increases as you make your monthly payments and reduce your mortgage balance. Web A home equity loan will increase your LTV if youre still paying PMI. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

That is 860 more than if the borrower kept paying the existing mortgage. To pay off your mortgage in this situation you would take at least 75000 and submit this amount to your mortgage company paying off the primary mortgage in the. Your score could benefit if you make timely payments and keep the amount you borrow from your HELOC relatively low but falling behind on your payments could mean bad news for your credit score and overall financial health.

If the borrower pays only interest during the draw period over the 20-year period of the HELOC interest charges total 30900. HELOCs are adjustable-rate loans and HELOC rates are based on two components. Web How a Home Equity Line of Credit Works HELOC lenders will generally let you borrow between 60 and 85 of your homes current appraised value minus your remaining mortgage balance.

The index for HELOCs is the Prime Rate which is a rate that changes as the Fed adjusts rates throughout each year. Web In fact a HELOC can affect your credit positively because it shows banks that you can handle various types of financial obligations over a long period of time. Web Your home is worth 250000 and you currently owe 180000.

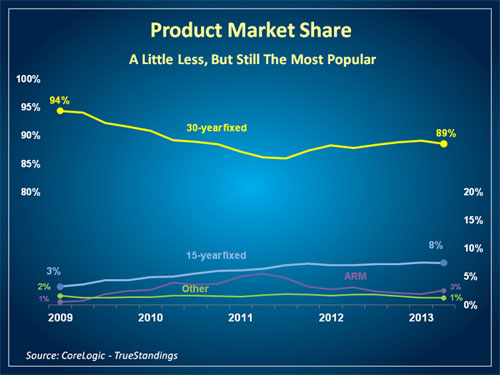

Web Equity is the amount youre left with after dividing what you owe on your mortgage from your homes current value. Lenders view applicants with higher credit scores as lower-risk individuals so theyre able to qualify for loans more easily. Web The average 30-year fixed-mortgage rate is 708 percent an increase of 7 basis points since the same time last week.

Proof of sufficient income or assets. A set base rate called a margin plus a fluctuating rate called an index. Web Having a HELOC is similar to having an adjustable-rate mortgage in that your monthly payments can change significantly when interest rates change.

Web A home equity line of credit or HELOC is another type of second mortgage loan. When it comes to your credit score your HELOC has a lot in common with a credit card. Web The main drawback of a HELOC is that it increases the risk of foreclosure if you cant pay the loan.

Web A home equity loan is a type of mortgage often called a second mortgage or a home equity installment loan that lets you draw on your home equity by borrowing against the homes value. You can take steps such as. At some point you may consider using the equity in your home to help you with a few.

Thats because it will take your principal balance even longer to drop to 80 if you submit a cancellation request or 78. 250000 80 200000. Web A HELOC mortgage payoff can also save interest.

Web Home Equity Line Of Credit - HELOC. Web If the lender allows you to borrow 80 of your homes value total you can have a combined loan balance of 160000 giving you a maximum HELOC credit line of 85000. 200000 180000 20000.

200000 - 150000 In this scenario you might be able to get a home equity line of credit of up to 50000. Web A HELOC can also affect your credit scorepositively or negativelydepending on how you manage the account. Web Top Reasons Not to Use a HELOC.

In this scenario you could potentially get a credit limit of up to 20000. You could expect to see a credit score increase if you. Web of mortgage plus HELOC.

Web A home equity line of credit HELOC can be an attractive option to tap this equity. A HELOC is a line of credit that you can draw against as needed for a set period of time typically up to 10 years. Web Various financial factors are included in your credit score such as student and automotive loans credit cards and lines of credit.

Annual Expenditure Curves For Us Fi Sub Survey Responders Plotted Across Various Groupings R Financialindependence

:max_bytes(150000):strip_icc()/HELOCvsCash-d39964f1fc034e3a8f98cb21c365ba84.jpeg)

How Does A Heloc Affect Your Credit Score

:max_bytes(150000):strip_icc()/RepaymentHELOC-a9531e37bec04853b34b19c1b39aee7a.jpeg)

How Does A Heloc Affect Your Credit Score

213 Road 250 Glendive Mt 59330 Zillow

Heloc To Pay Off Mortgage Youtube

How Does A Heloc Affect A Credit Score

Heloc Vs Mortgage Everything You Need To Know Canadian Mortgages Inc

Western Colorado Real Estate Today August 2022 By Real Estate Today Magazines Issuu

How Does A Heloc Affect A Credit Score

The Benefits And Risks Of A Second Mortgage Myhorizon

How Does A Heloc Affect Your Credit Score Cnet Money

:max_bytes(150000):strip_icc()/GettyImages-1350325088-86c03f9742e5421090b113a8dba58db8.jpg)

How A Home Equity Loan Affects Your Credit Rating

Replace Your Mortgage Exposed Youtube

Stephanie Weeks Will A Heloc Affect Your Credit Score

Will Paying Off My Heloc Hurt My Credit Score Nj Com

Mortgage Loans Vs Home Equity Loans What You Need To Know

:max_bytes(150000):strip_icc()/33627666341_d037a66b41_k-35d77c8dbc624410b1617350bfb32138.jpg)

5 Ways A Home Equity Line Of Credit Heloc Can Hurt You